What’s eating B2B SaaS | VentureBeat

Time’s almost up! There’s only one week left to request an invite to The AI Impact Tour on June 5th. Don’t miss out on this incredible opportunity to explore various methods for auditing AI models. Find out how you can attend here.

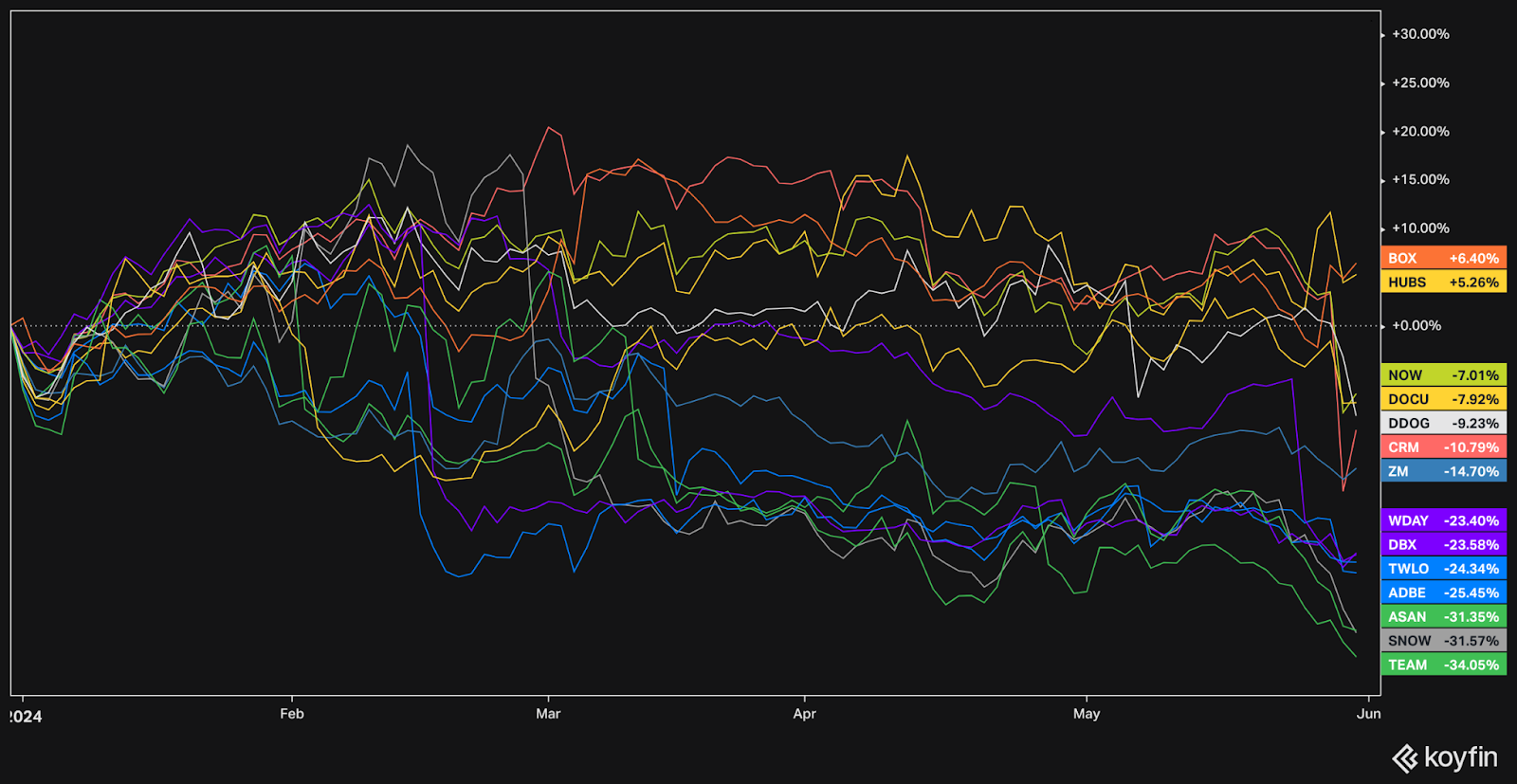

On Thursday, SalesForce (CRM) released weaker than expected earnings, resulting in the biggest 1-day decline in the stock since 2004. It was the latest in a string of disappointing earnings this season across the board from B2B SaaS companies.

This reporting quarter almost the entire B2B SaaS industry reduced guidance or disappointed investor expectations, including Asana (ASAN), Atlassian (TEAM), DataDog (DDOG),, Snowflake (SNOW), Twilio (TWLO), and Workday (WDAY).

It’s not AI (yet)

“Software is eating the world”, declared venture capitalist Marc Andreessen in a 2011 op-ed article for The Wall Street Journal. What came next was a long wave of Software-as-a-Service startups that crushed big box software incumbents, leading to some of the most successful IPOs of the last business cycle.

Recently however, there has been increasing speculation that large language models (LLMs) are a threat to the entire Software ecosystem. In an aptly named short essay titled “The End of Software”, venture capitalist Chris Paik of Pace Capital contends that can significantly lower the cost of software development and maintenance, leading to a proliferation of new, agile software solutions that could replace traditional SaaS models.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure optimal performance and accuracy across your organization. Secure your attendance for this exclusive invite-only event.

Paik argues this shift may result in a fundamental rethinking of how software is built, sold, and consumed, potentially rendering existing B2B SaaS business models obsolete as the market transitions to AI agents. He goes so far as to say “Majoring in computer science today will be like majoring in journalism in the late 90’s”.

There is little doubt that the likes of GPT and Github’s Copilot are already proving useful to software engineers. However, Paik and others on the “AI eats everything” bandwagon are probably underestimating the difficulty of the task. In a world where LLMs are struggling with basic math, reasoning, and hallucinations, it certainly seems far-fetched.

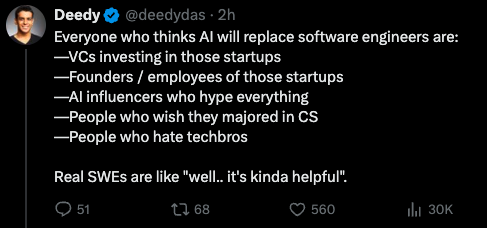

In a thread on X, Deedy Das, a venture capitalist at Menlo Ventures, offered a more circumspect view, writing “I think too many people trivialize all the things a good SWE actually has to do. AI might increase productivity, automate a bunch of tasks, but assisting [to the point of full automation] is a huge leap of faith.”

Das goes on to say that software job growth is slowing due to multiple factors, including overhiring, and ironically, the efficiencies created by software. But, says Das, the cause is definitely not “AI is taking over software”.

Diffusion of AI benefits

One of the core promises of technology innovation is the benefits accrue to everyone as adoption increases. Software and SaaS companies who adopt and integrate AI quickest will be the first to reap the gains, leading them to create features that are even more valuable to their customers.

In fact, we can already see this split emerging in the market, where nimble and niche-focused B2B SaaS companies are thriving even in the face of broader declines in the industry. Companies like Appfolio (APPF), AppLovin (APP), Q2 Holdings (QTWO), and Zeta (ZETA) are starting to split off from the pack as their earnings accelerate.

As the more mature SaaS companies integrate and deploy AI, and more importantly as they monetize it, they could see a return to higher growth.

Software’s problems are more mundane right now

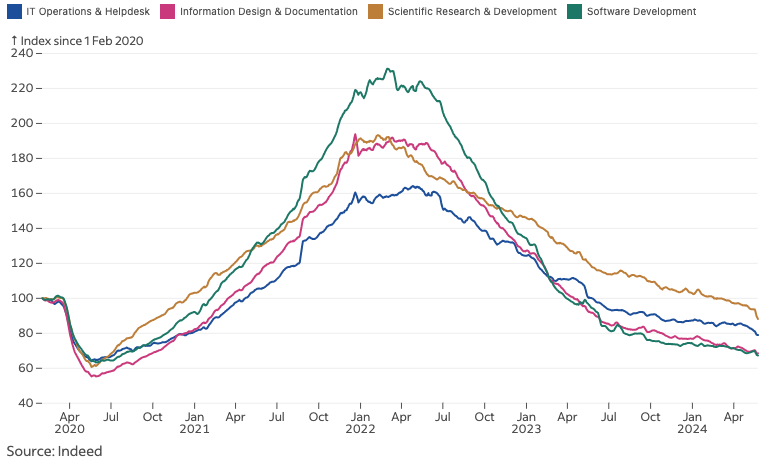

As Deedy Das suggested, the explanation for the recent decline in B2B SaaS revenues and earnings growth is more mundane. Companies over-hired during COVID and have been laying off high cost workers. According to tracking web site Layoffs.fyi, companies laid off 263,180 tech workers in 2023, followed by another 89,193 so far in 2024.

Most SaaS is priced by the seat. Given there is a direct correlation between the workforce reduction and revenues, this easily equates to billions of dollars in lost recurring revenues across the industry. Indeed, one of the main benefits touted by SaaS companies was this ability to scale up and down as needed without commitment.

Further, as macroeconomic conditions are putting pressure on companies to reduce costs, these SaaS bills are finally getting a lot of scrutiny. Some CIO surveys have suggested that up to 30% of SaaS spending could be waste.

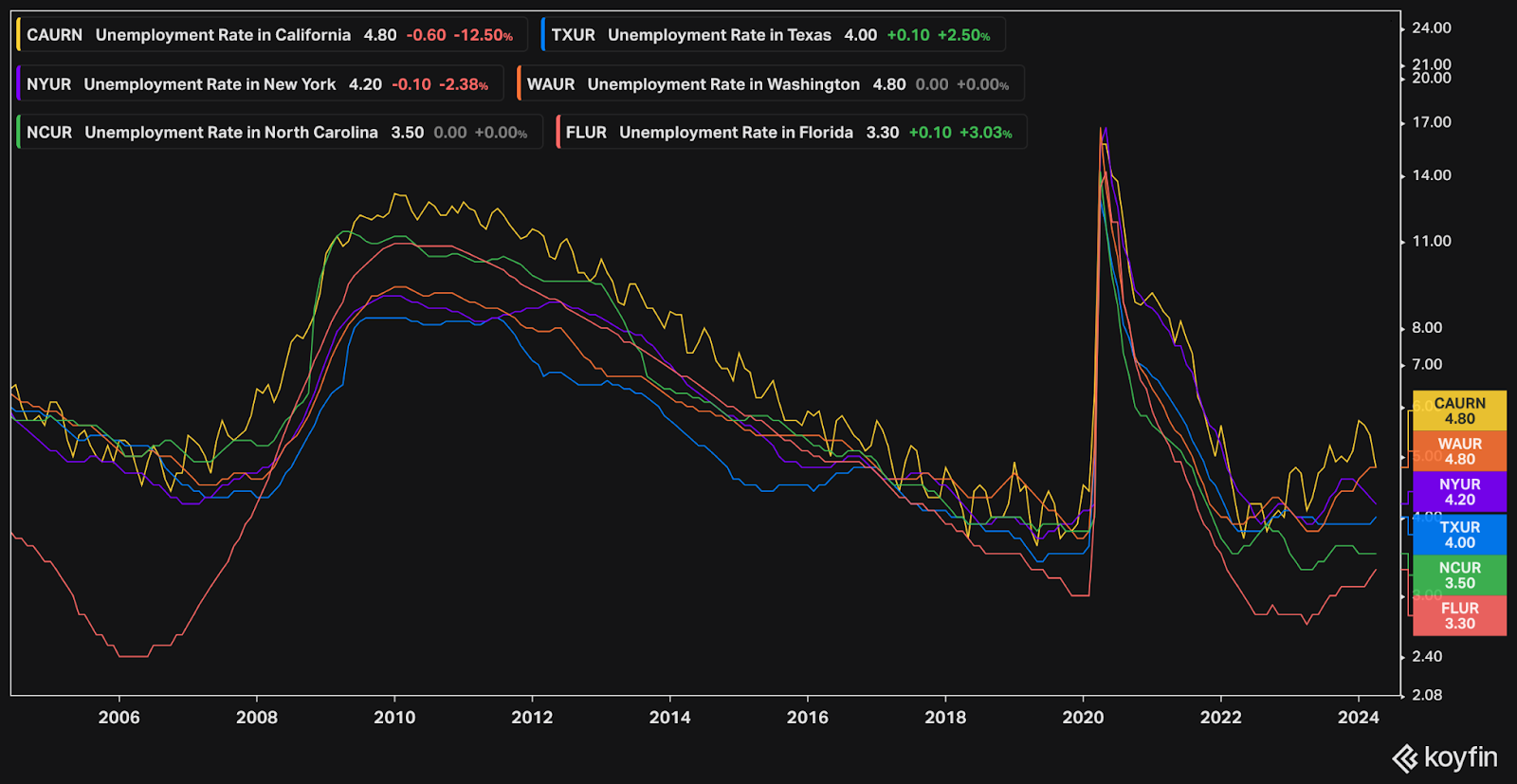

Meanwhile, the unemployment rate in California and Washington continue to rise, even as job postings for technical roles continue to decline from their peak in 2022. This suggests that, absent a sharp increase in economic growth and hiring, the SaaS industry will likely not return to growth in the near term.

Important Disclosure: The author is an active trader and investor and owns securities in some of the companies mentioned herein. This article is for informational purposes only and does not constitute investment advice. Facts and figures cited may contain errors and should not be relied upon for making investment decisions. Trading and investing carry the risk of financial loss. Always consult with a professional before making any investment decision.