Real Reasons For Bitcoin Crash Revealed, Not GBTC

In his latest essay, Arthur Hayes, the founder of BitMEX, articulates a contrarian perspective on the recent downturn in Bitcoin’s price, refuting the mainstream narrative that attributes the decline to outflows from the Grayscale Bitcoin Trust (GBTC). Instead, Hayes points to macroeconomic maneuvers and monetary policy shifts as the real drivers behind Bitcoin’s volatility.

Monetary Policy And Market Reactions

Hayes kickstarts his analysis by shedding light on the US Treasury’s recent strategic shift in borrowing, a decision announced by Janet Yellen on November 1. This pivot towards Treasury bills (T-bills) has triggered a substantial liquidity injection, compelling money market funds to reallocate their investments from the Fed’s Reverse Repo Program (RRP) to these T-bills, offering higher yields.

Hayes articulates the significance of this move, stating, “Yellen acted by shifting her department’s borrowing to T-bills, thus adding hundreds of billions of dollars’ worth of liquidity so far.” However, he contrasts this tangible financial maneuver with the Federal Reserve’s mere rhetoric about future rate cuts and the tapering of quantitative tightening (QT), pointing out that these discussions have not translated into actual monetary stimulus.

While the traditional financial markets, particularly the S&P 500 and the Nasdaq 100, responded positively to these developments, Hayes argues that Bitcoin’s recent price trajectory serves as a more accurate barometer of the underlying economic currents. He remarks, “The real smoke alarm for the direction of dollar liquidity, Bitcoin, is throwing a cautionary sign.”

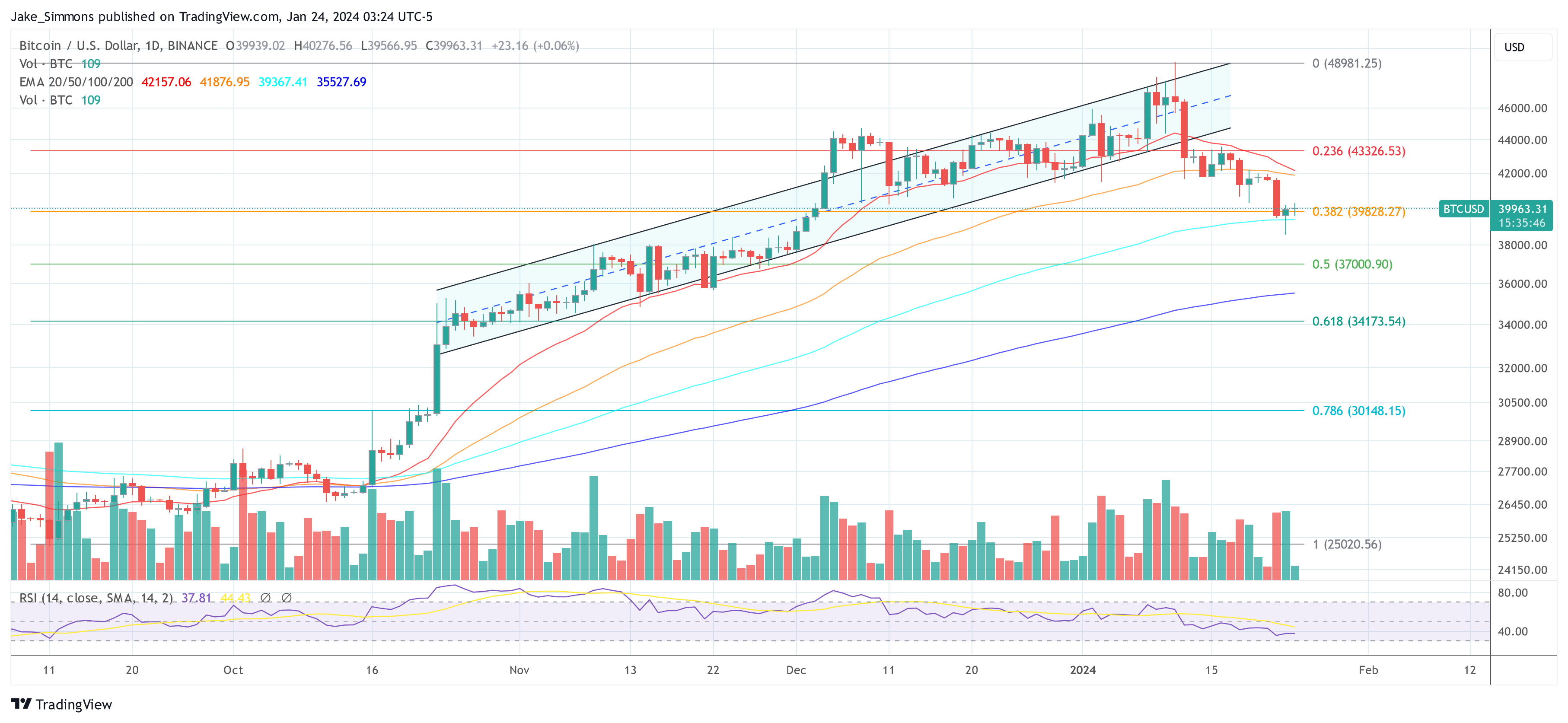

He notes the cryptocurrency’s decline from its peak and correlates it with the fluctuations in the yield of the 2-year US Treasury, suggesting a deeper economic interplay at work. “Coinciding with Bitcoin’s local high, the 2-year US Treasury yield hit a local low of 4.14% in mid-January and is now marching upwards,” Hayes remarked.

Dissecting True Reasons Behind The Bitcoin Dip

Addressing the narrative surrounding GBTC, Hayes emphatically dismisses the notion that outflows from GBTC are the primary catalyst for Bitcoin’s price movements. He clarifies, “The argument for Bitcoin’s recent dump is the outflows from the Grayscale Bitcoin Trust (GBTC). That argument is bogus because when you net the outflows from GBTC against the inflows into the newly listed spot Bitcoin ETFs, the result is, as of January 22nd, a net inflow of $820 million.”

This realization shifts the focus to economic mechanisms at play. The crux of Hayes’s argument lies in the anticipation surrounding the Bank Term Funding Program (BTFP)‘s expiration and the Federal Reserve’s hesitancy to adjust interest rates to a range that would alleviate the financial strain on smaller, non-Too-Big-to-Fail (TBTF) banks.

Hayes elucidates, “Until rates are reduced to the aforementioned levels, there is no way these banks can survive without the government support provided via the BTFP.” He predicts a looming mini-financial crisis in the event of the BTFP’s cessation, which he believes will compel the Federal Reserve to pivot from rhetoric to tangible action—namely, rate cuts, a tapering of QT, and potentially a resumption of quantitative easing (QE).

“I believe Bitcoin will dip before the BTFP renewal decision on March 12th. I didn’t expect it to happen so soon, but I think Bitcoin will find a local bottom between $30,000 and $35,000. As the SPX and NDX dump due to a mini financial crisis in March, Bitcoin will rise as it will front-run the eventual conversion of rate cuts and money printing talk on behalf of the Fed into the action of pressing that Brrrr button,” Hayes writes.

Strategic Trading Moves In A Turbulent Market

In a revealing glimpse into his tactical trading strategies, Hayes shares his approach to navigating the tumultuous market landscape. He discloses his positions, including the purchase of puts and the strategic adjustment of his BTC holdings. He concludes:

A 30% correction from the ETF approval high of $48,000 is $33,600. Therefore, I believe Bitcoin forms support between $30,0000 to $35,000. That is why I purchased 29 March 2024 $35,000 strike puts. […] Bitcoin and crypto in general are the last freely traded markets globally. As such, they will anticipate changes in dollar liquidity before the manipulated TradFi fiat stock and bond markets. Bitcoin is telling us to look for Yellen and not Talkin’.

At press time, BTC traded at $39,963.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.