Omidyar Network to pull out of India market

Omidyar Network, backed by eBay founder Pierre Omidyar, is shutting down its India operations, two sources familiar with the matter told TechCrunch, in a stunning development for the impact venture firm that has backed nearly 75 startups in the South Asian market.

TechCrunch couldn’t determine why Omidyar had decided to abruptly pull from the Indian market, a development that was shared with the local team Monday, a source familiar with the matter said, requesting anonymity as the matter is private.

Omidyar Network India unveiled five new investments in India in just last two months and its executives engaged in public conference as recently as Monday.

The firm didn’t respond to a request for comment Monday. Some of its partners in India also didn’t respond. After the publication of the story, Omidyar Network confirmed it won’t be making any more investments in India but didn’t say what happens to the local staff.

“Having achieved our primary objective of catalysing impact, Omidyar Network India will not be making any further investments in India,” a company spokesperson said in a statement.

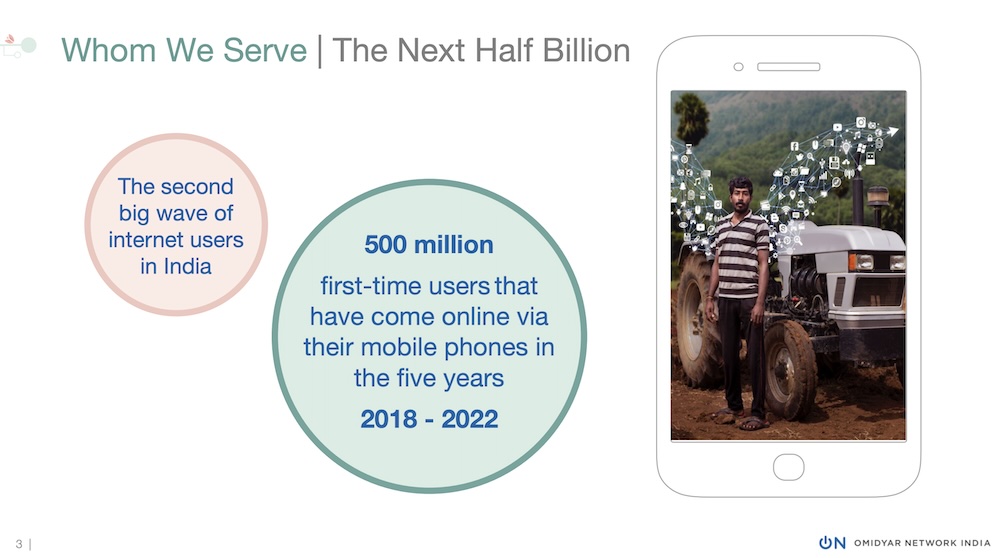

A slide from Omidyar Network India’s investor presentation.

A separate individual familiar with the situation said that the India team plans to attempt to reunite and raise money externally and start a new fund.

Omidyar Network aimed to back startups in India that, at least on paper, were solving problems faced by half a billion people in the country. Its portfolio startups include 1mg, Bounce, Bijak, DealShare, Doubtnut, Entri, HealthKart, Indifi, M2P, and Pratilipi.

As of July this year, Omidyar Network India had about $673 million of cumulative assets under management and its portfolio startups reached 735 million people, according to an investor presentation.

2023 has been a rough year for the Omidyar Network India team. Doubtnut, a startup which raised more than $50 million, sold for $10 million this month. And ZestMoney, once valued at nearly $450 million, also announced that it was shutting down. Both of them counted Omidyar Network India among their backers.

India has emerged as a key market for venture and private equity investors in the past decade as startups scale to serve the world’s most populous market. “India is the new China and the fastest growing major economy in the coming decade and beyond. We believe India offers the most attractive long-term investment appeal in our universe,” Baron Capital said in a quarterly report this year.

But it’s also true that many venture investors have struggled to make money in India.

Tiger Global’s Scott Shleifer said early this year on a call with Indian entrepreneurs that he believed that the South Asian market will deliver the highest equity returns globally in the future but admitted that the nation had historically delivered below average returns to the New York-headquartered giant.

“Returns on capital in India have sucked historically. If you look at the market-leading internet companies, whether it is Google, Facebook, Alibaba or Tencent, revenue for them got bigger than cost more than a decade ago. You had a great legacy of last 17-18 years of materially profitable internet companies. So returns on equity in the internet got really high and the returns for investors have been really high. But that did not happen in India,” he said.