Paris-based startup studio Hexa raises some funding to launch even more startups

You might not be familiar with Hexa, the Paris-based startup studio that has launched dozens of B2B software companies, but some of its portfolio companies have become well-known unicorns, such as Front, Aircall and Spendesk.

And it turns out that Hexa itself could be considered as a startup as the company just raised a funding round of $22 million in fresh capital (€20 million). This isn’t the first time Hexa raises outside capital. But it’s the company’s first round since 2016.

“We’ve got a few family offices investing, but we’ve mostly got local entrepreneurs investing like Luc Pallavidino (Yousign), Adrien Van Den Branden (Canyon), Paul Vidal (Collective) and Arnaud Schwartz (Marble),” Hexa co-founder Thibaud Elzière told me.

In other words, Hexa is raising from its own community of founders and friends. And this is just a first step as the company promises that there will be more funding in the coming months.

“This marks our initial close, and we anticipate a subsequent round in the new year. Our aim is to welcome even more family offices and entrepreneurs to join us on this journey,” Hexa co-founder Quentin Nickmans wrote in the funding announcement.

Hexa started its life as eFounders, a startup studio focused on B2B software-as-a-service startups. As it broadened its scope, it recently rebranded to Hexa so that each vertical (fintech, web3 and SaaS) would be handled by its own little startup studio.

The startup studio is also formalizing its fundraising process with this funding round. When Hexa decides to create a startup, they try to find the right founding team to iterate on this idea and turn it into their own project. At first, Hexa and its startup studios help for the basic building blocks, including product design, the go-to-market strategy, hiring and more.

After a year or so, when a startup is ready to raise some money to reach the next level, Hexa has been tapping its community of investor friends with something called the eClub.

For each startup, eFounders would create a special purpose vehicle (SPV), which is an ad-hoc investment vehicle created for a specific investment. Investors from Hexa’s eClub would invest in this SPV, which would then invest in the startup. Hexa itself keeps 30% in equity post-seed.

The eClub isn’t disappearing. Instead, it will be restricted to Hexa investors.

“Until now, we’ve operated with the eClub — we offered our pro rata rights to a group of investors in the form of SPVs. We’ll keep doing the same, but it will be reserved to the studio’s shareholders — which is also one of the reasons why people invested,” Elzière said.

Image Credits: Hexa

30 new startups per year

Arguably, it has never been so easy to create a software startup thanks to no-code tools, a wide range of SaaS services, cloud hosting and a simplified regulatory framework. So Hexa plans to take advantage of that by increasing the size of its batches and its overall pace.

Hexa expects to be able to launch 30 new startups per year. Of course, it won’t happen overnight. The startup studio is already thinking about hiring new team members to launch new verticals. When talking with the Hexa team in recent months, they’ve mentioned some of those potential verticals — climate, education and health.

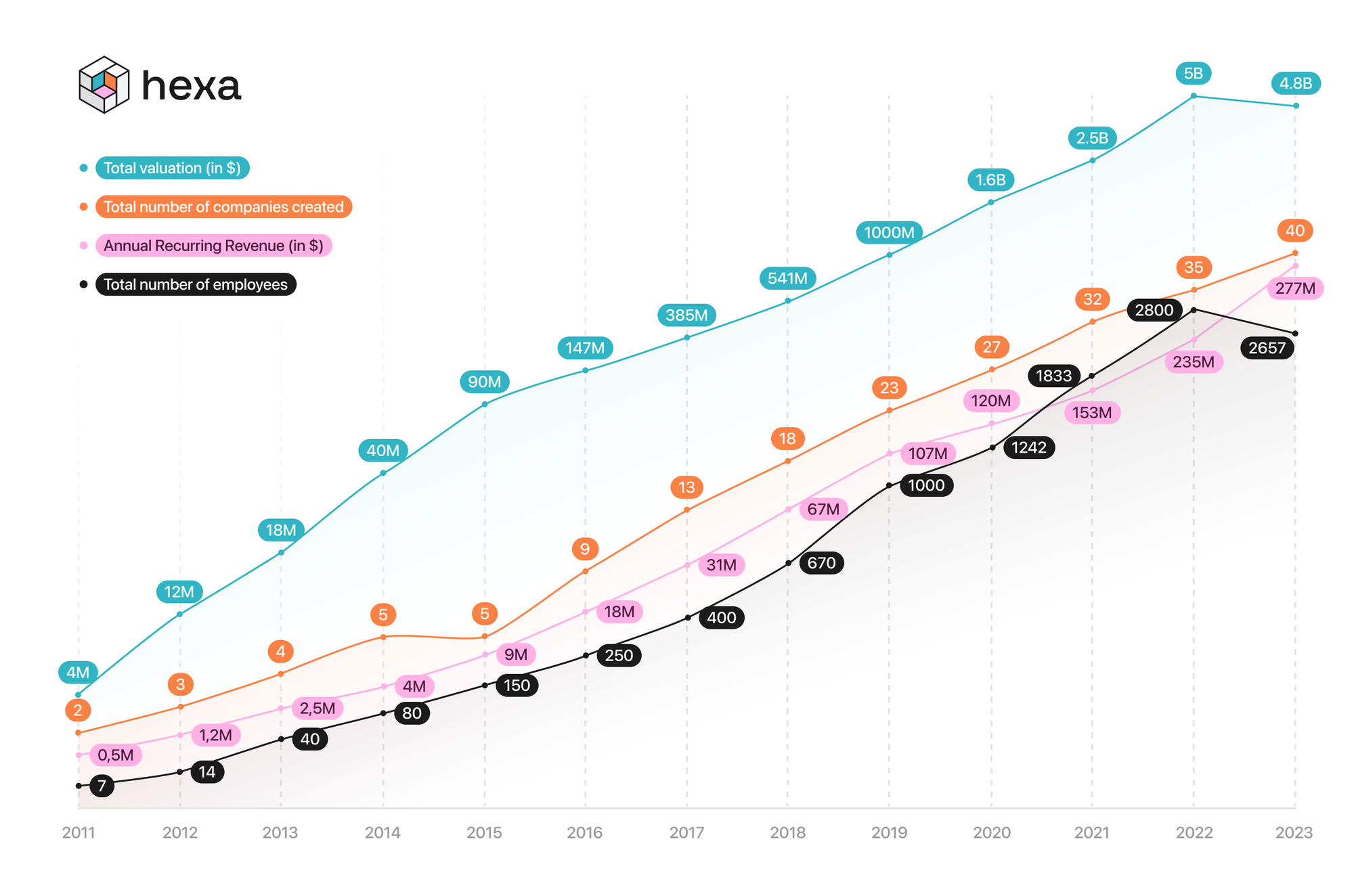

But it represents a huge increase compared to Hexa’s current pace of startup creation. Over the past 12 years, Hexa has created 40 companies — so that’s about 3 to 4 companies per year.

That vision will also depend on the macro environment for the startup ecosystem. Hexa portfolio companies — just like the rest of the tech ecosystem in Europe and the U.S. — are going through a rough patch.

While these portfolio companies currently generate a total of $277 million in annual recurring revenue (an impressive feat!), the total portfolio valuation is slightly down this year — from $5 billion to $4.8 billion.

In order to get back to work and try to make this number go up again, Hexa is also moving to a brand new office called La Cristallerie. The team will host meetups there and new startups will first work from there before they get their own office.

Image Credits: Hexa