Saviu Ventures’ second fund reaches €12 million first close to back Francophone Africa startups | TechCrunch

Saviu Ventures, a VC firm targeting startups in Francophone Africa, has made an initial close of €12 million for its second fund with the backing of private investors, including French and Kenyan family offices.

The VC firm aims to close the fund at between €30 million and €50 million to primarily invest in startups within Francophone Africa. It is said to be in talks with other stakeholders including institutional investors to hit the target.

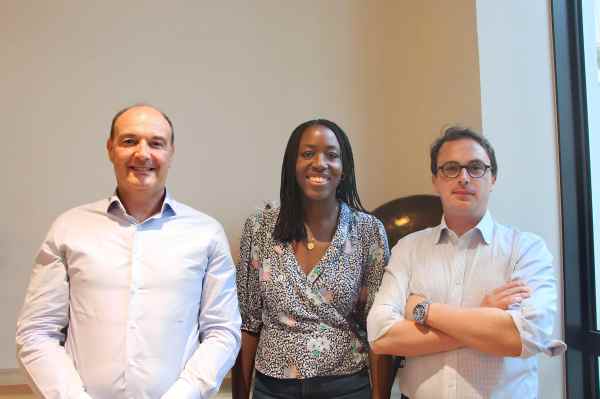

Founded by Benoit Delestre and Samuel Touboul, Saviu Ventures has been active in the Francophone Africa startup ecosystem since 2018, when it began deploying its first €10 million fund.

The VC firm invests in seed stage startups, and is sector agnostic, but, with the current fund, it is keen on fintechs, health-techs and climate-techs, while slowing down on e-mobility, e-commerce and e-logistics.

“We will follow the same strategy of our first fund, where our majority of our investment will go to startups in the Francophone region, but we still keep the opportunity to invest in East, Southern and North Africa startups that are keen on expanding to Francophone Africa,” Delestre told TechCrunch.

Saviu plans to invest between €500,000 and €3 million in 15 to 20 post-revenue startups with its second fund. Delestre and Touboul said the VC firm targets “sustainable companies” and extends business development support to these businesses in addition to the financial investment. The second fund has already backed Waspito, a Cameroonian health-tech; Rubyx, a Senegalese digital lending SaaS provider; and Workpay, a HR-payroll provider.

“We are looking for sustainable businesses. We don’t want to target unicorns because we are not interested in businesses or business models that insist on burning cash. Our belief is in supporting talented entrepreneurs building sustainable businesses,” said Touboul.

Saviu’s first fund invested between €250,000 and €500,000 in 12 startups, 82% of them from the Francophone region. Its portfolio companies include Anka (Afrikrea), an e-commerce platform; Julaya, an Ivorian neobank; Zanifu, a Kenyan digital lender; Lapaire, an eye-wear retailer with operations in Ivory Coast, Mali, Burkina Faso, Benin and Togo; and Paps, a Senegalese e-logistics startup.

Saviu is among the first VC firms that are specifically eyeing the Francophone region, an ecosystem that continues to attract VCs because of less competition, a massive market opportunity, and high-quality and better priced deals, in comparison to the more mature Anglophone regions.

Outside the big four (Egypt, Kenya, Nigeria, and South Africa), the Francophone region continues to be the next investment destination for VCs. According to the 2022 Partech report, the region accounted for 49% and 38% of the rest of Africa deals and funding, respectively, last year. Notably, Equity funding into the region remained nearly flat last year, after growing 2% to $527 million from 2021 when it recorded a mammoth 695% year-on-year growth.

“The ecosystem in francophone Africa is now much more developed than it was in 2018, when there were fewer founders and no incubators. It’s still very far from what you see in Kenya or South Africa but it is much better now,” said Delestre.