FTX trial stirs up more chaos as ex Alameda CEO Caroline Ellison testifies on faulty balance sheets, bribes and more

Welcome back to Chain Reaction.

To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

It’s week two of the Sam Bankman-Fried trial and I’m writing this live from outside the Southern District of New York courthouse where the case is taking place. (Tip: If you want to get into the main courtroom to sit behind SBF and listen in, you have to line up before 6 am or you’ll be sent to the overflow room.)

Tuesday was a slower day filled with technical details, but that changed on Wednesday and Thursday when Caroline Ellison, ex-CEO of Alameda Research, took the stand to testify.

Here’s a refresher on what you may have missed last week. (TC+)

Alameda is a big player in the trial as it’s the crypto hedge fund sister company of FTX. Bankman-Fried started Alameda back in 2017, two years before launching FTX. And in 2021, Ellison took over as co-CEO with Sam Trabucco as Bankman-Fried wanted to step away for optics, but still controlled the firm internally, she testified.

Ellison was the fifth witness for the prosecution and claimed that Bankman-Fried directed her to commit fraud and money laundering crimes. Ellison added that while she ran Alameda, she took several billion dollars from customers to invest in other projects and repay debts to lenders through an “essentially unlimited line of credit.” More details below.

For the latest updates check here.

The SBF Trial

- Former Alameda CEO Caroline Ellison explains how FTX hid losses, sandbagged lenders (TC+)

- Alameda Research allegedly paid Chinese officials around $150M to regain $1B worth of exchange accounts

- SBF started a $2 billion venture fund using Alameda loans

- Crypto is about a lot more than a former golden boy turned villain (TC+)

- ‘Marked to zero’: Paradigm testimony at SBF trial points to investor fraud

- Alameda had a $65B line of credit and ‘unlimited withdrawals’

The latest pod

For this week’s episode, Jacquelyn interviewed Grace Torrellas, Polygon Labs’ VP of product and zkEVM product lead and co-founder and executive director of Blockchain for Humanity, at TechCrunch’s Disrupt 2023 in San Francisco.

Blockchain for Humanity aims to use Bitcoin and blockchain technology to help social impact projects.

Separately, Polygon Labs is focused on the Ethereum blockchain through its own scaling protocols to make the web3 ecosystem more “affordable, secure and sustainable.” The chain also aims to grow the zero-knowledge Ethereum virtual machine (zkEVM) space.

Breaking it down for you: zkEVM is just fancy jargon for scalable smart contracts that are compatible with Ethereum and supports a type of computation known as “zero-knowledge proofs,” which verify each transaction.

Polygon Labs has more than 2.9 billion total transactions since inception in 2017. The Polygon network works with web3 organizations like Aave, Uniswap and OpenSea, as well as big name brands like Disney and Starbucks.

We talked about her work at both Polygon and Blockchain for Humanity and how humanitarian work can be advanced in the web3 space.

We also discussed:

- Scaling businesses with blockchain tech

- “Aha” moments in web3

- Opportunities in social impact

- Polygon’s ecosystem growth

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear!

Follow the money

- Blockchain gaming platform Game of Silks raises $5 million

- Crypto-focused trading and lending platform Membrane Labs raises $20 million

- On-chain data analytics firm Parsec raised $4 million

- Creator economy-focused RepubliK raised $6 million at a $75 million valuation

- Untangled Finance, a tokenized real-world asset platform, raised $13.5 million

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

What else we’re writing

Want to branch out from the world of web3? Here are some articles on TechCrunch that caught our attention this week.

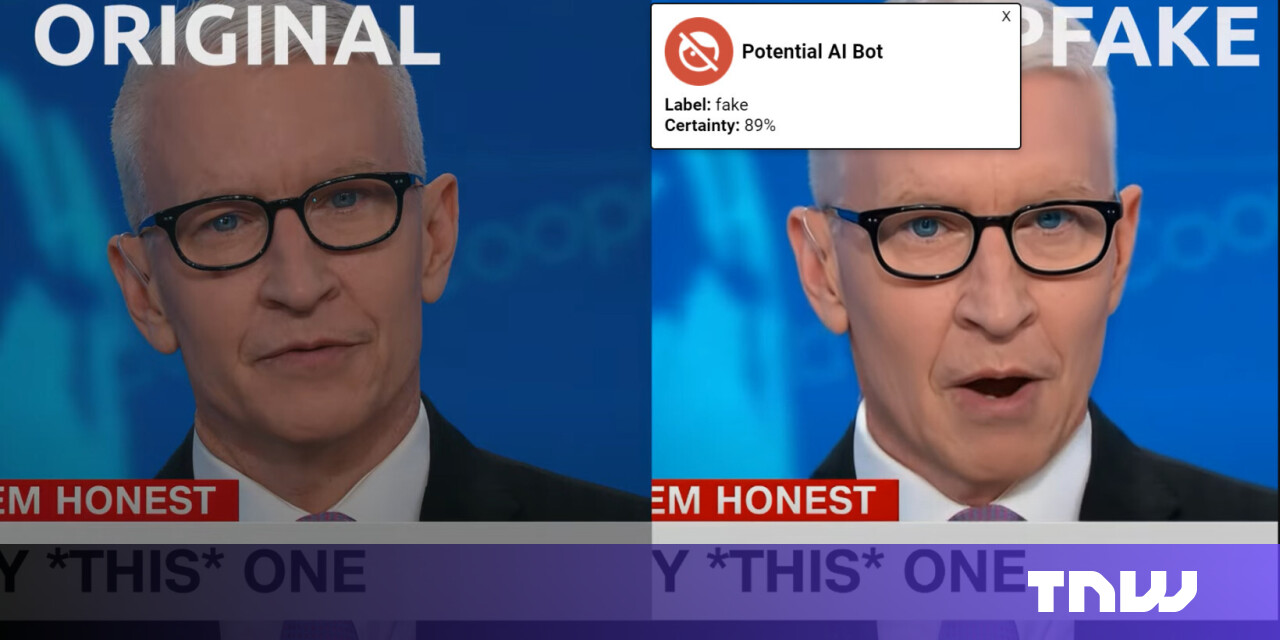

- Yepic fail: This startup promised not to make deepfakes without consent, but did anyway

- Fearing AI, fan fiction writers lock their accounts

- More money won’t fix your failing startup — here’s how to get investors to back a pivot (TC+)

- Investors suggest funds prepare for the fallout of the Fearless Fund lawsuit, not worry about it (TC+)

- Indian startups were not spared in the global venture slowdown of Q3 (TC+)

Follow me on Twitter @Jacqmelinek for breaking crypto news, memes and more.