Arm trades up in IPO debut that values firm above opening valuation of $54.5B

We’re thrilled to announce the return of GamesBeat Next, hosted in San Francisco this October, where we will explore the theme of “Playing the Edge.” Apply to speak here and learn more about sponsorship opportunities here. At the event, we will also announce 25 top game startups as the 2024 Game Changers. Apply or nominate today!

Arm, the chip architecture firm owned by SoftBank Group, raised $4.7 billion in its initial public offering that valued the company at more than $54.5 billion.

Trading on Nasdaq debuted above the $51 a share price, starting at $56.65 a share and rising to $60.06 a share in mid-morning trading Pacific time.

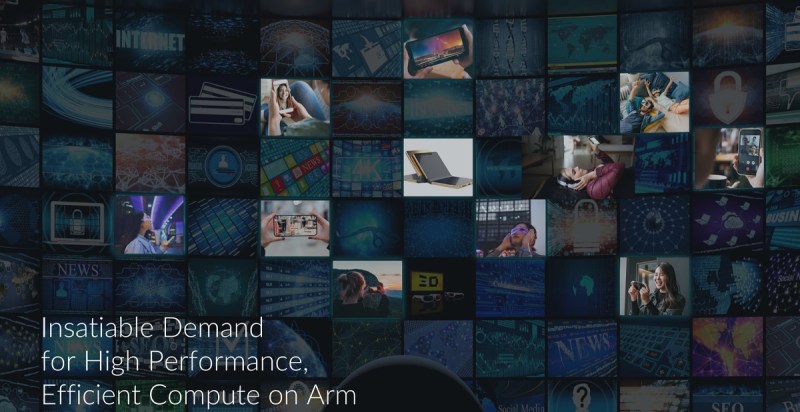

Cambridge, United Kingdom-based Arm chose to go public in the U.S., creating demand for the largest IPO in U.S. in the past two years. The company has a 99% market share in mobile phones, and it has made incursions into markets such as processors for PCs and servers.

Arm’s devices are always energy efficient, as the company’s architecture is a descendant of RISC computing, which focused on energy efficiency while Intel’s rival architecture focused more on performance.

Event

VB Transform 2023 On-Demand

Did you miss a session from VB Transform 2023? Register to access the on-demand library for all of our featured sessions.

But the weak global market has hurt sales lately. Overall sales totaled $2.68 billion in the 12 months ending March 31, compared to $2.7 billion in the year earlier period. Arm has tried to compensate by moving aggressively into the automotive chip market and other areas as well.

“When you think about the breadth, and the pervasiveness of what we’ve achieved when you think about the fact that we’ve built the most pervasive CPU architecture in history, [our partners] have shipped 250 billion devices since our inception, delivering 31 billion units in the last financial year,” said Will Abbey, chief commercial officer at Arm, in an interview with VentureBeat.

“I wouldn’t get too focused on day one trading or day two trading,” added Abbey. “We’re a growth stock. The fundamentals of who we are, and what we’ve done is all about developing solutions in growth markets. So automotive is growing. Cloud and infrastructure are growing. IoT is growing, mobile is growing. And so we’re going to continue to develop performance and power efficient solutions that are backed by a world class ecosystem. And so that’s what’s going to enable us to scale.”

The importance of semiconductor chips

Chips are the foundation of the modern electronics industry. They’re the thumbnail-sized slivers of silicon that, when processed, have billions of components known as transistors on their surfaces. They’re laid out in circuitry that would be more complex than a street map of the globe. A typical semiconductor processor these days has more transistors than 16 times the number of people on Earth.

Back in 1971, Intel’s first microprocessor had 2,300 transistors. Today, the latest Arm-based Apple Watch has 5.9 billion transistors. The reason is the compounding effect of Moore’s Law, the prediction made in 1965 by Intel’s former CEO Gordon Moore, that held that the number of transistors on a chip would double every couple of years.

With such improvements in efficiency, our electronic goods have gotten better every couple of years. They become faster, cheaper smaller, enabling smaller and smaller electronic devices. Moore’s Law has slowed down lately, but the advances are still coming fast. Apple’s latest M2 Ultra processor for its Macs has 134 billion transistors.

The industry hit $574 billion in 2022, a year when the shortage of such chips crippled many industries that were whipsawed by the demand changes during the pandemic. A shortage of chips in 2022 idled Ford’s factories for many weeks of the year, as there weren’t enough chips to put in the finished cars. It’s also why game consoles were in such short supply years into the cycle of the Xbox Series X/S and PlayStation 5. Shortages like this did untold damage to the world economy.

Chips were such a strategic industry that Congress approved the CHIPS and Science Act in 2022, authorizing $280 billion in new funding to boost domestic research and manufacturing of semiconductor chips in the United States. And Arm is one of the companies that designs the framework — dubbed architecture — for processors that are the brains of the electronic equipment.

“We built the most pervasive CPU architecture in history. Today, everything is a computer of sorts. The Arm CPU is the brain of the modern computer. So from smartwatches, to sensors in your home, to thermostats in your home,” Abbey said. “To automotive, to the cloud, to the infrastructure that the cloud is dependent upon. Arm is in everything. And it is worth pondering the importance of AI. And the fact that AI is everywhere. Also, the growth of AI will be the growth of the future.”

Competive viewpoint

Intel and Advanced Micro Devices are rivals with a focus on x86 architecture, most commonly used in PCs, servers and game consoles.

MIPS is also a rival, and Arm also faces competition from an upstart technology, RISC-V, that is being offered as an open-source alternative with no royalties. It was created by a group of academics who were mortified at the fees that Arm was charging even for research purposes.

Arm is still 90% owned by SoftBank.

As for open source competition, Abbey said, “We contribute to open source. We have done that from the very foundations of what we do. So whether it’s Linux or more, we’re a big believer in open open source tools, open source software, and we’re a big contributor to that. When you think about a CPU, I think it’s really important that we underscore the fact that no CPU is really relevant without a software ecosystem. Arm has the broadest software ecosystem support of any CPU architecture ever. And so that that’s the way you should look at the relevance of a CPU. You need to build it, you need to deliver performance, it needs to be delivered in an efficient, power constrained way. And you need to have this broadness of the software ecosystem. Developers care about ease of use. Developers care about longevity. I think that differentiates who we are.”

Arm by the numbers

Arm has 5,963 employees from more than 85 countries. About 80% of them on focused on research, design and technical innovation. The company’s engineers invested 10 million hours creating the base software and tools for chips with Armv8 processors. And Arm spent 30 million hours creating the base software and tools for Armv9 processors.

Arm said that in 2023, the total addressable market for its chips is $200 billion in chip value, and that could grow to $250 billion by 2025.

Besides smartphones, Arm is chasing after AI, automotive, computer infrastructure, the internet of things, and chips embedded in appliances and other devices.

Arm said it has more than 1,000 ecosystem partners, meaning the licensees and other supporters who make chips based on Arm’s architectural designs. It’s like Arm designs the framework for a car, and then the chip design and manufacturing firms create individual car models based on the overall structure of having an engine and four wheels.

Asked about Arm’s future, he said, “I focused on AI. The pervasiveness of AI is going to drive the need for greater level of performance. But performance in a power efficient way. It’s also going to enable us to take a step back and think about new application areas. Think about the ecosystems that are going to be relevant, the software ecosystems are going to be relevant to unlock the potential of AI. And so it brings me full circle Dean back to the tenets of our DNA: performance, power efficiency and software ecosystem. Those three tenets are what enabled us to scale in mobile.”

But Arm also needs to pay attention to geopolitical issues. The U.S. and China have a frosty relationship, and both sides are racing to secure chip supply chains. China accounted for 24.5% of Arm’s revenue in the last fiscal year.

Japan-based SoftBank will still own more than 90% of Arm in the wake of the IPO. Nvidia tried to buy Arm for at least $40 billion, but regulators put a stop to that deal. To shore up its shareholder support, Arm enlisted many clients as cornerstone investors in its IPO, including Apple, Nvidia, Alphabet, Advanced Micro Devices, Intel and Samsung Electronics.

As for being at Nasdaq at Times Square in New York, Abbey said, “Pretty exciting, amazing day. It’s a reflection of the great work that many individuals have contributed to this amazing day. I have a

permanent smile now glued to my face. I can’t quite remove it. It’s been photo after photo after photo. The best part for me is just the Time Square and, and seeing pictures around billboards.”

He added, “I recognize that we’re so fundamental to our to compute, and that we are everywhere. Just seeing our names, just all over the big buildings in New York has been super, super important and super, super sort of rewarding.”

I noted that Arm is usually behind the scenes.

“I think that we’re not behind the scenes, we’re fundamentally enabling compute. Compute is everywhere,” said Abbey. “Whether it’s a smartwatch or SmartLock, whether it’s a data center, whether it’s automotive, the CPU is the brains of all compute today, the fact that we’re so fundamental, and it’s a recognition of all the hard work that we’ve done in terms of performance, power and efficiency, and an amazing software ecosystem that’s taken us to where we are today. So it’s a celebration of the past, it’s a realization of the present. And it’s an exciting future when we think about where we’re going to go next.”

GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it. Discover our Briefings.